3 strategies for retirement income planning

THREE STRATEGIES FOR RETIREMENT INCOME PLANNING

In the novel Bailey’s Café, Gloria Naylor writes of a fictional restaurant in which there is no menu, and only one item is available from Monday through Saturday. Our approach to retirement planning is the exact opposite. Depending on your specific income needs, lifetime goals, and existing positions, we will create a customized plan tailored specifically for you. While the details of each plan vary from investor to investor, we have found that most investors fall into three categories, each of which requires dramatically different approaches to retirement planning.

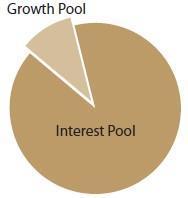

Interest-only

For the ultra-affluent investor, current assets will be able to generate enough income to last for a lifetime. For these investors, we develop a defensive-minded strategy, relying on various risk management techniques and possibly insurance products to mitigate risk and transfer wealth to the next generation. With a majority of the client’s assets locked into fixed income, the shortcoming of this portfolio is that it fails to achieve anything beyond limited asset growth. We invest a portion of this portfolio in equities, however, so that asset growth does not lag behind the rate of inflation.

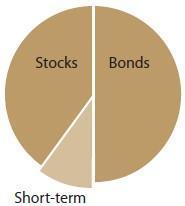

Well-balanced

For affluent investors who have saved substantial wealth throughout their lives, we can build a customized portfolio that matches their risk tolerance and investment objectives while striving to achieve the asset growth that will enable a comfortable lifestyle. These investors have a large enough asset base that their risk tolerance matches their liquidity requirements. We need not take on more volatility than they desire in order to generate additional income. These portfolios are often split evenly between stocks and bonds, with a small portion kept in money markets for short-term income needs. When implementing this portfolio, tax management techniques need to play a role, and it is also necessary to rebalance regularly in response to the natural fluctuation of the markets.

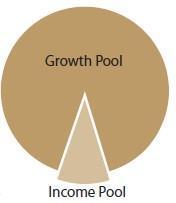

Growth-oriented

For investors who have not saved enough to cruise through retirement, we attempt to construct a portfolio that focuses on asset growth. These investors may be advised to stomach more volatility than they would like, but need to consider investing in vehicles that have the potential to increase their assets most dramatically. The further away from retirement an investor is, the more suitable this approach may be. A majority of the portfolio will be dedicated to asset growth, and a smaller portion will seek to provide the investor with an income pool. As with the well-balanced portfolio, it is necessary to rebalance this account periodically in response to market fluctuation.

There is no one approach to retirement planning. With this in mind, we construct customized portfolios for unique clients. Whether you are looking for a conservative interest-only portfolio, a well-balanced portfolio, or a growth-oriented portfolio, we have the tools and experience to build the right distribution model for you.

Cahill & Associates Financial Services, LLC 75 Berlin Road, Suite 110, Cromwell, CT 06416 | P860.635.4800 | F860.635.4572

Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser.